Withholding

Advertisement

Breaktru PAYROLL 2014 v.14.2.0

Payroll Software Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only. small business

Advertisement

Breaktru PAYROLL 2015 v.15.1.0

Payroll Software Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only. small business

Tax Withheld Calculator v.4.12.1.1

If you are an employer or another withholding payer, the TWC helps you work out the tax you need to withhold from payments you make to employees and other workers.

SoftConn Small Business Payroll v.1 4

Small Business Payroll gives the ability to handle payroll processing quickly and efficiently whether your needs are simple of complex. Support for all federal, state and local withholding calculations as well as unemployment, disability, EIC,

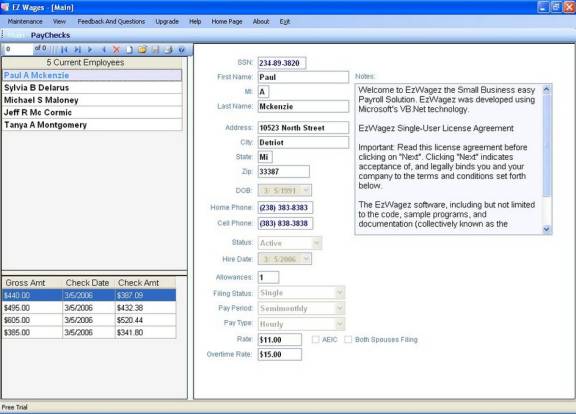

EzPayCheck v.3.2.8

ezPayCheck is a comprehensive and affordable full featured small business payroll preparation and check printing software. ezPayCheck automatically calculates net pay, federal withholding tax, state withholding tax, Social Security tax,

Paycheck Free v.1.4.0.0

Use Free Paycheck Calculator to calculate net paycheck amount and taxes from your payroll information. Now updated for year 2012! Paycheck Free calculates net pay amount and applicable payroll taxes: - Federal Withholding, - Social Security, -

Dictionary of Tax Terms v.1.0.0.0

From Amortization to Withholding Tax, the Dictionary of Tax Terms is a one-stop resource for information on a subject that affects each and every one of us. Packed with over 700 key terms,

Payrollguru v.1.3.0.0

Payroll Guru calculates net paycheck amount from gross wages for Salaried and Hourly paid employees. Now updated for year 2012! Payroll Guru calculates net pay, Federal Withholding, Medicare, Social Security, State Withholding and State

Paycheck Calculator v.1.0.0.0

Paycheck Calculator calculates net paycheck amount and applicable payroll taxes from a gross pay amount. Paycheck Calculator calculates the following payroll taxes in all 50 states and District of Columbia: - Federal Withholding, - Social

Pay Check v.1.1

This utility calculates US Federal Withholding, Social Security and Medicare taxes during calendar year 2011.